-

SDG: 12

• Directors

• Employees

• Board members

• Suppliers

• Accredited repair workshops

• Service Providers

Other (includes financial agents, manufacturers, implementers, press/media)

2020 INTEGRATED ANNUAL REPORT

MESSAGE FROM THE ADMINISTRATION

Áudio

MESSAGE

2020 was marked by our discipline in operations when we managed to implement all planned

actions, with the necessary adjustments due to the Covid-19 pandemic. This reinforced the

resilience of our business model in both favorable and recessive economic environments and led

us to overcome the challenges in a positive and effective manner.

Our track record of achievement motivates us to dream big and set ambitious goals. We are

convinced of our ability to face future challenges, especially as we have a committed and

results-driven team, without which our growth would not be possible.

Click here to read the full message

IDENTITY

Áudio

ABOUT US

Controlled by our holding company, SIMPAR, we are Grupo Vamos, listed on B3's Novo Mercado and leaders in the rental sector for trucks, machinery, and equipment in Brazil. We are, therefore, the best choice for the renewal of the national fleet. We operate in three segments and our operating structure includes more than 15,000 leased assets and a network of 43 stores in 11 states.

Click here to view our profile.VALUES

We believe in:

Slide to the side to see more!

Customers: understanding in order to serve and ensuring a

lasting relationship.

People: who are committed to their work make a difference

in our business.

Simplicity: in our way of being and doing things.

Quality: ensuring agile delivery according to the expected

specifications, schedule, and value standards.

Profit: Fundamental to sustainable development.

TIMELINE

Creation of the company's DNA

1950

Purchase of first truck and founding of JSL

1990

First lease agreements (trucks and equipment) and first customer asset purchase agreement

Expansion

2007

Acquisition of Transrio/VW/MAN in the Southeast Region

2010

Management of the VW/MAN truck and bus dealership in the South Region and expansion of the VW/MAN dealership network to the Midwest and Northeast regions

Visibility

2015

Creation of Vamos to centralize and expand JSL's rentals, dealerships, and pre-owned stores

2017

Acquisition, by Vamos, of rentals and dealers of agricultural machinery and equipment

Rapid organic growth

2019

IPO, in category A, providing access to the capital market; consolidation of processes, controls, and systems; and concession agreement entered into with Komatsu to operate in the states of Mato Grosso and Mato Gross do Sul

2020

Vamos becomes a subsidiary of SIMPAR; consolidation as a leading truck and equipment rental company in Brazil; largest VW/MAN dealer network in the country; and largest chain of pre-owned vehicle stores with nationwide coverage

2021

IPO and opening of the 1st Fendt store.

OUR BUSINESS

Áudio

VAMOS LOCAÇÃO (VAMOS RENTAL)

Our core business is the long-term leasing of trucks, machinery, and equipment (average lease term of 60 months or more) with assets that are critical to our customers' business.

VAMOS CONCESSIONÁRIAS (VAMOS DEALERSHIPS)

In this segment, we provide qualified services through:

• 14 Volkswagen/MAN dealerships, the largest network in the country, selling new and pre-owned trucks as well as parts, accessories, and maintenance services.

• 15 Valtra stores, with the largest national coverage area in terms of revenue potential, operating in the agricultural machinery and equipment market.

• Two Komatsu stores, with products that include hydraulic excavators, wheel loaders, crawler tractors, and motor graders.

• The newest Fendt brand store, globally recognized for its technology in the agribusiness sector.

VAMOS SEMINOVOS (VAMOS PRE-OWNED)

Our network of pre-owned equipment reaches the most important markets in Brazil. Our 11 stores are strategically positioned to complement the rental market with a high capacity to sell leased assets at the end of their lease agreements. In 2020, we sold 1,796 trucks, rolling stock, machinery, and equipment with an average age between five and six years.

Click here to learn more about our operationsBUSINESS MODEL

MANUFACTURED

CAPITAL

Input

• A single, innovative, and integrated business platform (12,793 trucks and 2,335 machines and pieces of equipment)

• Fleet Renewal Program

Outputs (value added)

• Development of the national fleet (2.5 years - average age of our assets vs. 20.7 years - average of the Brazilian fleet)

• 95% reduction in the emission of particulate matter, considering the average age

• More safety on the roads (fleet of 15,128 assets, 5,900 with some type of tracking device/telemetry, which accounts for nearly 30% of the total fleet and nearly 50% of motorized vehicles)

• Tax benefits to customers (deductions on income tax, PIS, and Cofins)

FINANCIAL

CAPITAL

Input

• Growth strategy focused on synergy and complementarity (R$ 1.28 billion invested in new lease agreements in 2020)

Outputs (value added)

• R$ 179 million in net income

• R$ 639 million in EBITDA

• Representation of leading brands, such as VW, Valtra, Komatsu, and Fendt

• Listed on B3's Novo Mercado - Brasil, Bolsa e Balcão

• Boost to regional and national economies (52% of purchases made from local suppliers)

HUMAN

CAPITAL

Input

• Team dedicated to training in and continuous improvement of the services provided (9.96 hours of training per employee in 2020, with more than 9,000 hours of training offered)

Outputs (value added)

• Valuing people and respecting diversity (47% Black employees)

• Health and safety in operations (0.56 work-related injury rate)

• Customer satisfaction (Quality zone in the NPS methodology)

SOCIAL AND

RELATIONSHIP CAPITAL

Input

• Instituto Julio Simões

• ESG principles integrated into the business strategy

• Global Compact

Outputs (value added)

• Social engagement and volunteering (more than R$ 1.2 billion earmarked for incentive social projects)

• 52% from local suppliers, such as accredited repair workshops

• Reduction in the number of road accidents

• Approximately 350,000 people benefited by Instituto Julio Simões

NATURAL

CAPITAL

Input

• Program to address Climate Change and the Intelligent Use of Natural Resources

Outputs (value added)

• Offsetting through 100% carbon neutrality

• Reduction of GHG emissions by 4.5%

• Reduction of waste and consumption of natural resources: 4% less waste generated and 21% drop in water consumption compared with 2019

• Incentives for the chain of repair workshops to agree to commit to proper waste disposal (1,008 new repair workshops in 2020; 2,608 in total)

2020 HIGHLIGHTS

Áudio

Start of our operations as Komatsu distributors in the Midwest.

Agreement entered into with Fendt, of Grupo Agco, the global leader in technology for agricultural equipment.

Lowest historical default level reached.

Record net income of R$ 179.2 million

Implementation and development of new systems and digital platforms, which drove the scalability of our business.

Expansion of the sales team allowing for greater coverage

Establishing priorities within the scope of ESG.

Caminho +B diagnostic to initiate the process to certify Vamos as a B Corporation

Approximately 360,000 people impacted by Instituto Julio Simões, to which we make regular contributions.

Adherence to the Global Compact.

Provide customers the opportunity to offset emissions and commitment to neutralize 100% of emissions (Scopes 1 and 2) by Dec/21.

STRATEGY AND MANAGEMENT

Áudio

We operate under a single, innovative business platform, grouping in one ecosystem several solutions, with synergy and complementarity. Our business strategy is in line with ESG principles and has the following priorities:

• Customer satisfaction

• Corporate culture and governance

• Valuing people and respecting diversity

• Health and safety

• Climate change

• Intelligent use of natural resources

Click here to learn more about our managementESG PRINCIPLES

Our projects are structured in three dimensions, with clear objectives, performance indicators, goals, and schedules for completion.

Click here and learn more about the projects

MANUFACTURED CAPITAL

Áudio

OPERATIONAL PERFORMANCE

We have a well-structured commercial team spread throughout all regions of Brazil, a back office area prepared to provide online support to operations using various digital tools, and we have been expanding our reach year by year. In addition to these differentiators, we offer flexibility in meeting the needs of our customers and additional services that can be contracted.

VAMOS LOCAÇÃO

In 2020 we made great strides in diversifying our customer portfolio and in the sectors of the

economy where we operate:

• In 2020, we executed 407 new contracts, 123.6% more than in

2019.

• Our year-end portfolio of 319 customers was 115.5% higher than

in the previous year.

• Our future contracted revenue ("backlog") as of December 31,

2020 was R$ 3.1 billion, up 44.3%.

VAMOS CONCESSIONÁRIAS

Due to the pandemic, we readjusted the organizational structure of the stores and restructured costs and expenses. Furthermore, our performance was marked by:

• The partnership signed with Komatsu do Brasil, through which we became distributors of machines and equipment of the Japanese brand's yellow line for the states of Mato Grosso and Mato Grosso do Sul.

• Agreement signed with Fendt, through which we became the largest representative of the brand in Latin America.

VAMOS SEMINOVOS

Our trucks have an average age of 2.5 years. They are considered extremely new, since the average age of the fleet in Brazil is 20.7 years. We have 11 stores across the country and sales expertise to extract the maximum possible value in this segment.

Click here to learn more about our performance.

FINANCIAL CAPITAL

Áudio

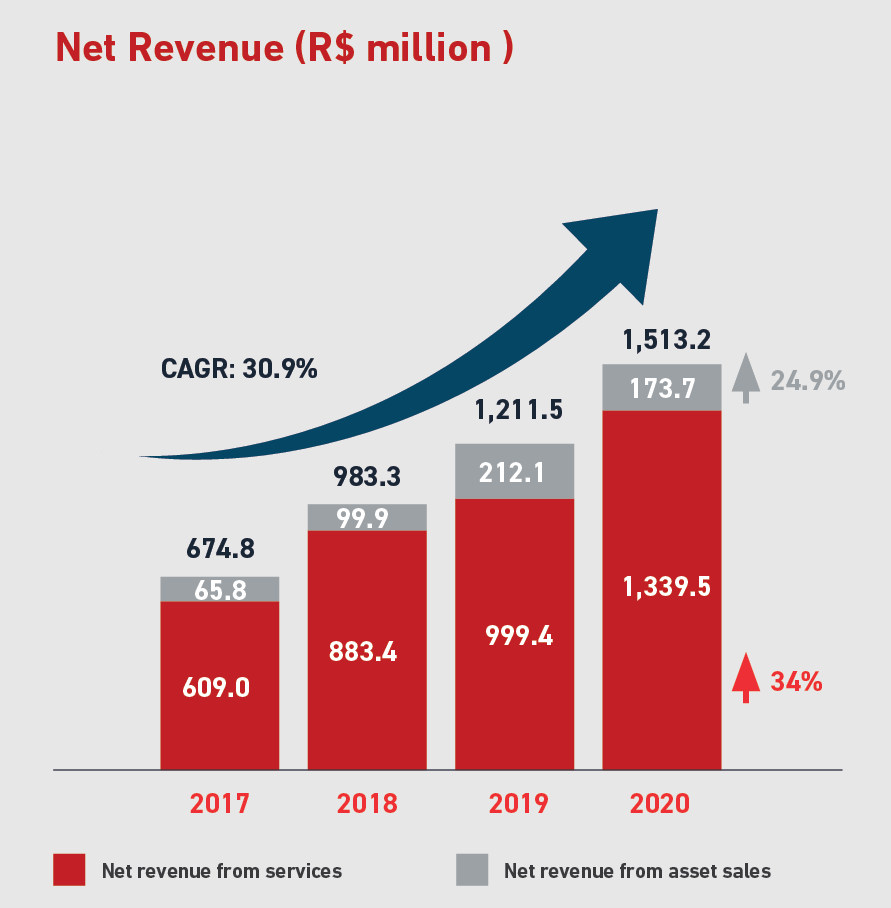

Economic and Financial Results

In 2020, we evolved in all our financial indicators, which proves the resilience of our business model. CAPEX reached R$ 1.3 billion in 2020 in long-term leases with our customers, up 76.8% compared with R$ 727 million in 2019.

NET REVENUE

Net revenue grew as a result of the increase in our commercial coverage, supported by technology tools to accelerate our go-to-market strategy.

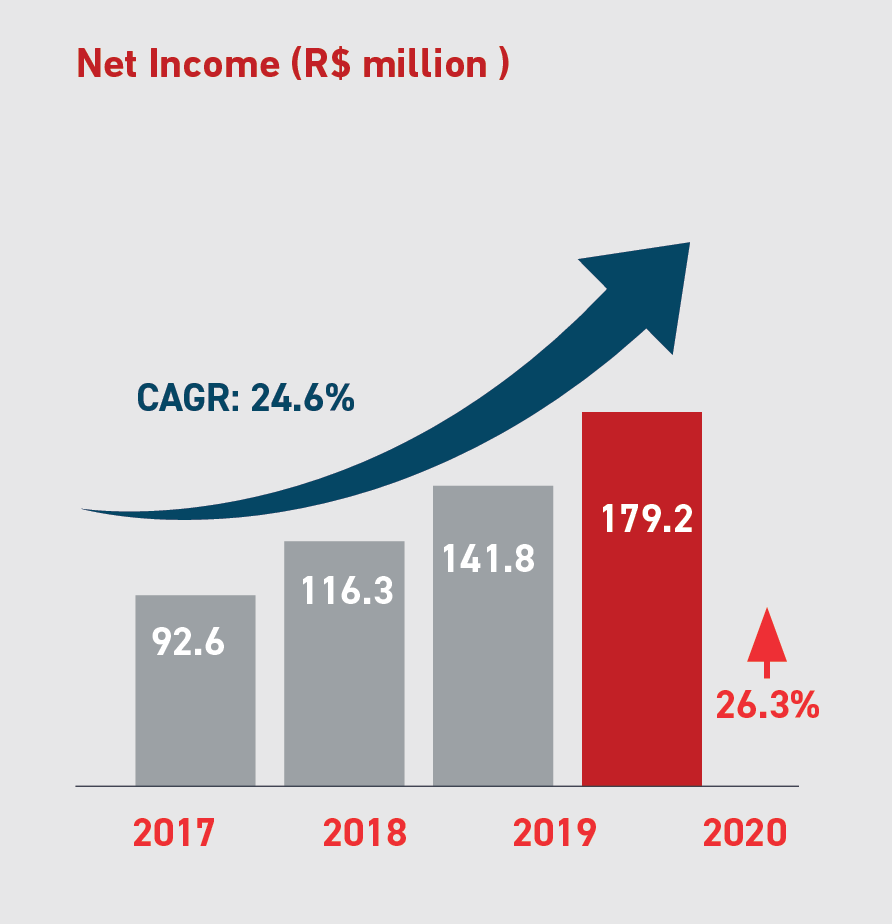

NET INCOME

Our net income reached R$ 179.2 million, the best result in our history, reflecting the strong organic growth in all business segments.

Click here to see our economic and financial results.

Click here to see our economic and financial results.

HUMAN CAPITAL

Áudio

INTERNAL AUDIENCE

By the end of 2020, our team had 948 professionals, who receive continuous and multidisciplinary training to promote professional development and skills for everyday life. We also believe in learning by example.

| Number of employees by gender | 2018 | 2019 | 2020 |

|---|---|---|---|

| Men | 563 | 753 | 752 |

| Women | 156 | 196 | 196 |

| Total | 719 | 949 | 948 |

HEALTH AND SAFETY

In addition to initiatives resulting from the pandemic, we promoted intense campaigns geared toward truck drivers, which led some of our branches to set a record number of days with no accidents. Increased awareness was noted in the need to use Personal Protective Equipment (PPE).

Click here to learn more about our teams and our people management.

SOCIAL CAPITAL

Áudio

CUSTOMERS

We seek to develop more than our businesses. We strive to develop the market in which we operate, driving innovations that increasingly cater to the entire customer journey. We operate with synergy and complementarity and offer a series of differentiators , such as the mobile electric repair workshop. We offer three basic service packages and one customized package according to the customers' needs.

Click here to see our customer appreciation initiatives.SUPPLIERS

We ended 2020 with 1,934 suppliers in our supply base where we spend a significant volume of resources: R$ 1.18 billion. Our procurement policy prioritizes local companies in order to contribute to the development of the surrounding area. In this way, in addition to efficiency, our supplier management stands out for its concern in valuing the production chain.

Click here to learn more about our production chain.COMMUNITIES

Our aim is to consolidate our social investment strategy to generate an increasingly positive

impact on society through initiatives that have synergy with our business and with the actual

development needs of each location in which we operate.

In operation since 2006, Instituto Julio Simões manages the investments of the companies that

are part of SIMPAR, our holding company, in the development of their projects. In 2020, we

transferred more than R$ 277,000 to Instituto Julio Simões and allocated funds to

incentive-based social projects in the amount of R$ 1,218,748.92.

NATURAL CAPITAL

Áudio

ENVIRONMENT

Environmental preservation is inherent to our business, with the replacement of our current fleet with newer vehicles that consume less fuel and significantly reduce the emission of greenhouse gases (GHG). We also pay special attention to waste management and to reducing consumption of natural resources through the establishment of goals.

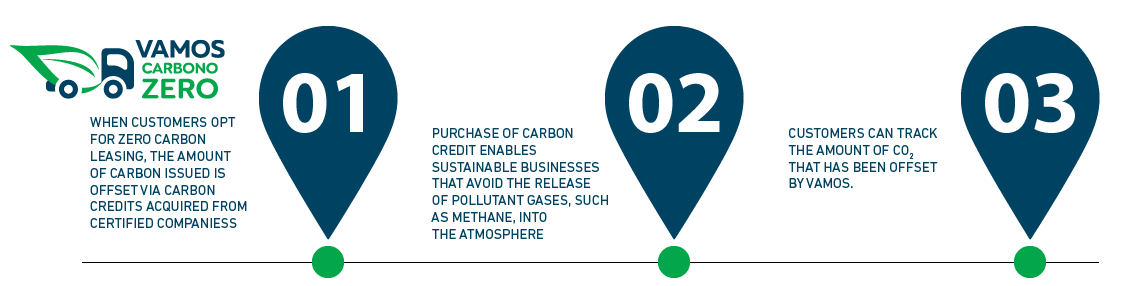

Click here to see our environmental preservation initiativesVAMOS CARBONO ZERO

In line with the priorities we have assumed under the ESG principles, climate change and intelligent use of natural resources, we neutralized all our carbon emissions in 2019 and 2020, and this practice will also be made available to customers through Vamos Carbono Zero.

Entenda a locação com Carbono Zero

Arraste para o lado e veja mais!

ABOUT THIS REPORT

Áudio

Committed to our stakeholders and to transparency, our first Integrated Annual Report was prepared in line with recognized practices:

• GRI Standards

• Principles of the International Integrated Reporting Council

• Disclosure recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)

• Carbon Disclosure Program (CDP) Data.

MATERIALITY

Click on the titles to see more!

-

SDG: 3, 7, 12, 13, 14, 15

• Directors

• Board members

• Accredited repair workshops

-

SDG: 12, 16

• Directors

• Board members

• Suppliers

• Accredited repair workshops

• Service Providers

Other (includes financial agents, manufacturers, implementers, press/media)

-

SDG: 16

• Directors

• Employees

• Automakers

• Service Providers

Other (includes financial agents, manufacturers, implementers, press/media)

-

SDG: 3, 4, 5, 8 and 10

• Directors

• Employees

• Board members

• Suppliers

• Automakers

-

SDG: 8, 9 and 12

• Directors

• Employees

• Board members

• Suppliers

Other (includes financial agents, manufacturers, implementers, press/media)

-

SDG: 8 and 16

• Board members

• Suppliers

• Service Providers

-

SDG: 1, 2

• Directors

• Board members

-

SDG: 9

• Directors

• Employees

• Automakers

• Specialized workshops

• Service Providers

Other (includes financial agents, manufacturers, implementers, press/media)